Cost of Buying and Owning Property in North Cyprus

Author :Harper Özbirim

INSPIRATION

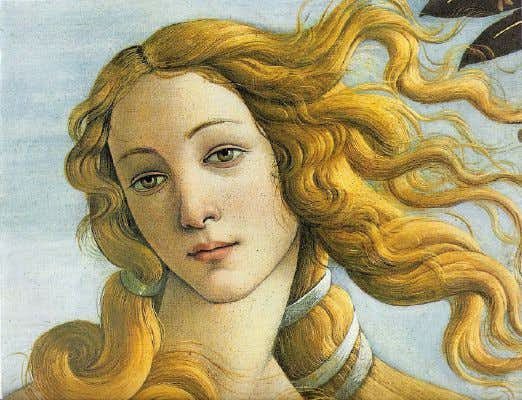

6 May, 2020 - 10:41 pmWelcome to one of the most beautiful corners in the world. With its convenient geographical position and rich history, Northern Cyprus is an attractive place for everyone’s favourite dream residences.

Northern Cyprus is an attractive place for everyone’s favourite dream residences. That’s why buyers from all over the world prefer North Cyprus to achieve the right earnings in line with their investment strategies and to lead a long-term holiday. Well, who doesn’t want to live in a place having more than 300 days of sunshine?

Let’s have a look at how buying property in Northern Cyprus is easy - because it is based on the British model - and which charges potential buyers of properties in North Cyprus should be aware of.

VAT&Stamp Fees On Properties In North Cyprus

So you decided to buy your property and found the perfect fit! Being well-informed about North Cyprus’ policies beforehand is the best thing to do.

VAT: If bought from the developer, 5% VAT on top of the purchase price is applied. If the process is “re-sale”, then the VAT is not reapplied.

Stamp Fee: It is 0.5% of the total purchase price and is paid to the Tax Office.

Northern Cyprus is an attractive place for everyone’s favourite dream residences. That’s why buyers from all over the world prefer North Cyprus to achieve the right earnings in line with their investment strategies and to lead a long-term holiday. Well, who doesn’t want to live in a place having more than 300 days of sunshine?

A warm host since 3000 BC: historical values of Alsancak

The ancient city of Lambousa, one of the most interesting areas around Alsancak, makes you feel like you are living in a time period in ancient times with its historical structures such as Lambousa Fish Tank, queen pools, rock tombs, street fountains, monasteries and churches. Again, you will have touched the ruins that were revealed as a result of excavations in that region and whose history dates back to 3000 BC. You can see Byzantine, Lusignan, Venetian, Ottoman and British influences in the city, which has hosted different civilizations throughout history.

If you are ready to follow the tales, let me share with you a wonderful piece of information: Another feature of the Girne Mountains, where Alsancak is located; St. Disney, inspired by the world-famous Walt Disney when creating the fairy tale “Snow White”. It also houses the Hilarion Castle. You will be witnessing history with your own eyes as you watch with amazement how the castle resembles the castle in the fairy tale “Snow White”. Along with the dazzling beauty of the historical structure of the castle, you will be amazed by the clean and warm waters of the Mediterranean in its view.

Sincere and close: Alsancak culture

The people of Alsancak, who love sociality and cooperation, are known for giving great importance to sports as well as social activities. The most characteristic feature of the people of Alsancak (including myself) is that they have a special personal structure that combines village and city life. The people of Alsancak are strong emotionally, love to communicate face to face, attach importance to neighborly relations, and work for a sustainable life towards nature. knows how to combine the innovations, conveniences and entertainment of city life in their lives; They also provide each other with the opportunity to live comfortably and peacefully, and most importantly, freely, by holding on to the values of love, respect and tolerance.

All kinds of options from village coffee to 5-star hotels, always at your side

Village that love sociality and cooperation, give greate importance to sport and social activities.